African Tantalum – Tantalum/Lithium Operation

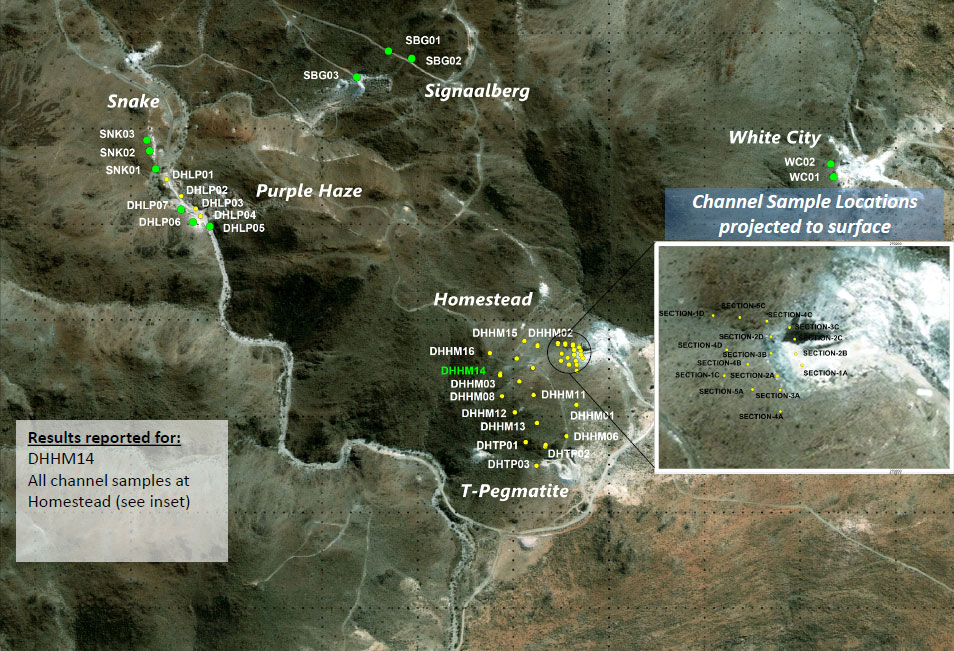

African Tantalum – Tantalum/Lithium Operation, located in South Eastern Namibia

Kazera Global first invested in African Tantalum (Proprietary) Limited (“Aftan”) in 2014 when a 75% interest was acquired for £0.66 million. The remaining 25% was acquired in 2020 for a further £0.22 million. Aftan initially held a 60% interest in the Tantalite Valley Mine (“TVM”), located in South Eastern Namibia. This was increased to 100% in 2015.

In July 2022, Kazera announced an agreement to secure a non-dilutive US$7.5 million investment in return for a 49% stake in the Company’s marketing, sales, and export subsidiary for all lithium production from the TVM.

Subsequently, in December 2022, Kazera agreed to dispose of African Tantalum (Pty) Ltd (“Aftan”) for a cash consideration of US$13 million plus a debenture payment of 2.5% of the gross sales of produced lithium and tantalum for life-of-mine. Completion of the sale was subject to receipt of full consideration proceeds.

Aftan was deconsolidated from the Company’s financial statements with effect from 4 January 2023 because, in accordance with the terms of the sale agreement, it relinquished control of Aftan in favour of the purchaser, Hebei Xinjian Construction Close Corp (“Hebei”) with effect from that date. Kazera retained the right to cancel the transaction and retain all amounts paid to date in the event of default by Hebei Xinjian.

Following default by Hebei, Kazera initiated legal proceedings in September 2024, which have now concluded in Kazera’s favour with the Company announcing an arbitration award exceeding US$11.9 million, including interest, plus coverage of legal costs on 7 May 2025.

Kazera is now assessing the most effective legal and commercially beneficial avenues to enforce the award and recover the full amount due.

Tantalite Valley Mine resources

Discover more...

Kazera Global plc is an investing company listed on AIM, focused principally, but not exclusively, in the resources and energy sectors.

Kazera is an investing company, focused principally, but not exclusively, in the resources and energy sectors. The Company is listed on London’s AIM market (ticker: KZG).

Kazera is committed to being a responsible operator and meeting good international industry practice standards, and placing the safety and wellbeing of employees first.

Find out more through our media and insights. View press releases, video interviews, image galleries and social media.